Buying a new house is a major life decision—and one of the biggest financial investments you’ll make. Many people may fall into these traps or make mistakes when they are purchasing their first home. In this article, JDL Realty will help you understand 10 mistakes that you may avoid in advance! If you’re planning to buy a new home, here are 10 common mistakes to avoid:

1. Not Creating a Realistic Budget

Before house hunting, determine what you can afford, not just what a lender will approve. Factor in all monthly expenses, including retirement savings, education funds, and lifestyle costs. Experts suggest keeping your total debt under 36% of your gross income.

2. Choosing the Wrong Mortgage

Many buyers rush to get pre-approved but overlook the loan type. Fixed vs. variable rates, term lengths, and payment flexibility all affect your long-term costs. A 15-year mortgage may cost more monthly but saves on interest over time.

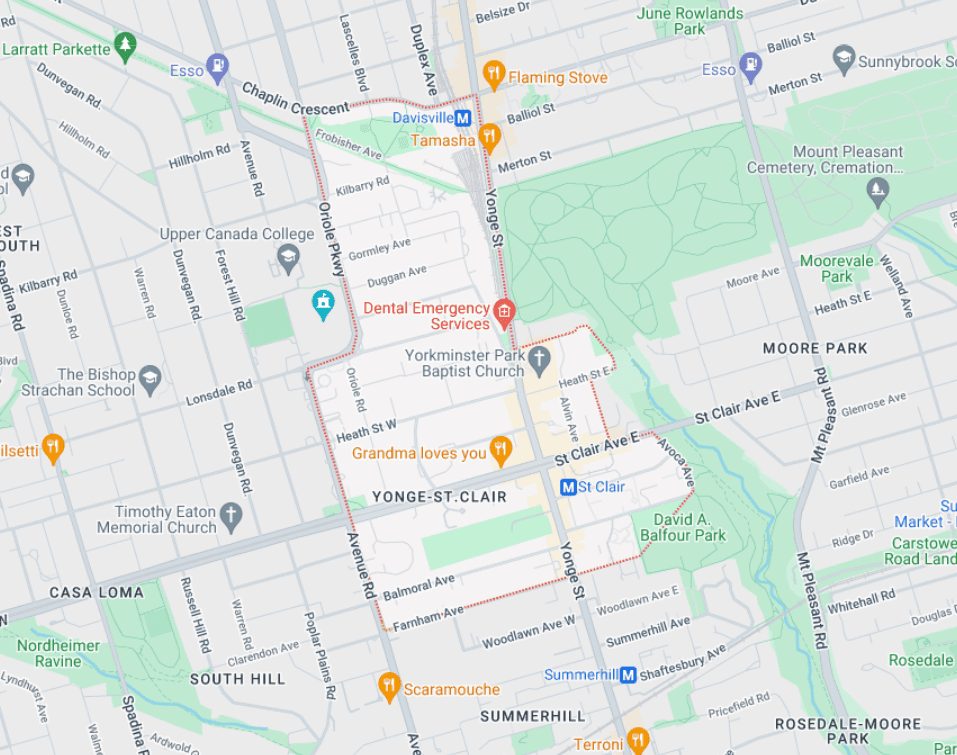

3. Ignoring the Neighbourhood

“Location, location, location” isn’t just a saying. Investigate school quality, transit access, noise levels, and safety. A cheaper home in a less desirable area may cost more emotionally and financially in the long run.

4. Not Understanding the Home’s True Value

Compare similar homes in the area to see if the price is fair. Real estate agents can help you access recent sales data and market insights.

5. Hiring the Wrong Real Estate Agent

Choose an agent with experience in the neighbourhood you’re targeting. Read reviews, ask for referrals, and interview a few agents to find one that understands your needs.

6. Skipping a Visit During Off-Hours

Visit the home at different times of day—especially evenings and weekdays—to check for noise, traffic, or other issues you might miss during a weekend open house.

7. Skipping a Home Inspection

Even a new home can have issues. Hire a certified inspector to evaluate the roof, structure, plumbing, and electrical systems. This protects you from costly surprises later.

8. Forgetting About Resale Value

Think long-term: Is this house easy to sell in the future? Consider layout, curb appeal, and proximity to schools or public transit.

9. Overpaying for the Area

Don’t buy the most expensive house on the block—it may not appreciate in value as expected. Try to stay within the price range of surrounding homes.

10. Underestimating Closing Costs

Closing costs can equal 2%–5% of your purchase price. Preparing 5-10% more cash for legal fees, taxes, appraisal, insurance, and moving expenses. Sometimes, if you are purchasing your

Ready to Buy Your New Home?

Avoiding these mistakes will make your journey smoother and smarter. Talk to a trusted real estate agent, compare mortgage options, and do your homework—buying a new house should be exciting, not stressful.

Your Industry Experts

We’re here to help. Whether you’re an agent or a client, we have the support and expertise you need to thrive in your next endeavour.